UCOs for EU Biofuels Smells Like Soy and Rapeseed, Not Palm Oil

Update July 25, 2024

Bosnian-American Biofuel Fraud Case Moves Forward in Belgium

Two Bosnian-Americans accused of being “ringleaders” in a US$3.4-million biofuel fraud case should be released on bail set at 50,000 euro (US$54,245) each, a court in Antwerp ruled on Tuesday.

The European Public Prosecution Office (EPPO) appealed the ruling. The suspects will remain under electronic surveillance until the appellate court reaches a decision in two weeks.

Paula Telo Alves, an EPPO press officer, told OCCRP that she could not provide more details about the case as “this is an ongoing investigation, and there is nothing else that we can share at this moment, in order not to endanger the ongoing procedures and their outcome.”

Belgian police arrested the men in May following investigations of illegal imports of biodiesel into the European Union, according to the EPPO.

“The two suspects are understood to be the ringleaders of a criminal organisation that imported biodiesel of U.S. origin into the EU, while fraudulently declaring its origin as Morocco,” the EPPO said in a June 28 statement. More OCCRP

--------

Update July 22, 2024

Transport & Environment, the notorious Europe-based NGO with an anti-palm oil agenda continues its tirade against palm oil.

It is worth repeating here that UCOs from China are ten times more likely to contain deforestation from Brazilian soy than palm oil.

According to the latest data from Statista:

In 2023, China's soybean import volume amounted to approximately 99.41 million metric tons, representing a slight increase of about nine percent from 91.08 million metric tons in the previous year. Soybean is one of the most imported agricultural products in China.

Increasing soy imports has led to decreasing palm oil imports. According to Reuters:

Palm olein imports to top buyer China could fall by 26% to 3.1 million metric tons in 2024 as the most widely used edible oil loses pricing edge over rival soy oil, an executive at Cargill Investments (China) Ltd said on Wednesday.

A record South American soybean crop has pushed down prices for the primary competitor, which typically trades at a premium to palm oil, hurting demand for the latter.

With palm oil losing market share in China due to its higher cost compared to soy, the other source of vegetable oils for the EU's biofuels programme is rapeseed. This must frighten Transport & Environment which has shied away from any criticism of rapeseed for biofuels as it is the major European crop for EU biofuels.

Rapeseed Oil remains a Primary Feedstock For German Biodiesel according to industry group Union zur Förderung von Oel- und Proteinpflanzen (UFOP).

Rapeseed also happens to be a major Chinese seed oil crop with annual productions several times more than its import of palm oil. In terms of realistic percentages of, Chinese UCOs are most likely to contain soy, followed by rapeseed before palm oil.

Yet Transport & Environment offered only crickets when UFOP warned there will not be enough rapeseed to feed and fuel the European Union. Sustainably that is.

Fact finding on China’s UCOs exports

The EU's use of agricultural lands to produce rapeseed for biofuels is questionable when food security for the EU is not assured. What is assured is the protectionist stance to protect European rapeseed industries is risking the EU's goals to decarbonise the transport sector with the aid of biofuels. That’s a long debate for another day but getting back to the spike in Chinese UCOs.

Bloomberg reported on the issue:

A spike in Chinese exports to Europe over the past year has coincided with a significant increase in Chinese imports of palm waste and palm-based biofuel from Indonesia and Malaysia. This should explain why Chinese exports of UCOs were able to react so fast to Europe's demand for UCOs.

But imports of palm waste or even palm-based biofuel pales in comparison to the enormous potential for China to produce biofuels from its own waste oils. The thing is that way before used cooking oils found demand in transportation, an illegal industry for gutter oil was already thriving in China

Grist reported back in 2010 on the prevalence of gutter oil or swill oil being reused as cooking oil. This disgusting industry was covered by the Washington Post in You may never eat street food in China again after watching this video

A report by MICHÈLE ZOLLINGER in 2015 for Yale Environment Review found that:

China's food culture depends heavily on cooking oil for daily use. In fact, the country produces 2.73 times as much gutter oil as the European Union, the U.S. and Canada combined. However, 10 percent of this cooking oil comes from illegally used gutter oil, which threatens human health. SkyNRG, a Dutch company and world leader and supplier in sustainable jet fuel, succeeded in producing aviation biofuel from waste cooking oil. Thanks to China's abundant waste oil there is a huge potential to recycle Chinese waste oil for bio jet fuel production.

The Chinese government’s crackdown on gutter oil has reduced the use of gutter oils for consumers but the collection network installed by this illegal industry may explain why China has so much used cooking oils to offer to towards its UCOs exports.

The origins of China's used cooking oils is impossible to trace beyond the haphazard declarations of Transport & Environment that it contains virgin palm oil. One can only expect more crickets from T&E to the trade and vegetable oil industry data presented above.

Meanwhile SP Global reported that Southeast Asia to play significant role in SAF production but lacks policies and cooperation. Malaysia has presented itself as capable of meeting international standards including CORSIA, EURefuel and the US's Sustainable Aviation Fuel Roadmap. A Malaysian source of SAFs simplifies supply chain complexities as Malaysian palm oil wastes would most certainly contain mostly palm oil. This may keep T&E up at night when EU transport decarbonisation goals are met with palm oil in the form of used cooking oils and agri wastes.

Bosnian-American Biofuel Fraud Case Moves Forward in Belgium

Two Bosnian-Americans accused of being “ringleaders” in a US$3.4-million biofuel fraud case should be released on bail set at 50,000 euro (US$54,245) each, a court in Antwerp ruled on Tuesday.

The European Public Prosecution Office (EPPO) appealed the ruling. The suspects will remain under electronic surveillance until the appellate court reaches a decision in two weeks.

Paula Telo Alves, an EPPO press officer, told OCCRP that she could not provide more details about the case as “this is an ongoing investigation, and there is nothing else that we can share at this moment, in order not to endanger the ongoing procedures and their outcome.”

Belgian police arrested the men in May following investigations of illegal imports of biodiesel into the European Union, according to the EPPO.

“The two suspects are understood to be the ringleaders of a criminal organisation that imported biodiesel of U.S. origin into the EU, while fraudulently declaring its origin as Morocco,” the EPPO said in a June 28 statement. More OCCRP

--------

Update July 22, 2024

Transport & Environment, the notorious Europe-based NGO with an anti-palm oil agenda continues its tirade against palm oil.

It is worth repeating here that UCOs from China are ten times more likely to contain deforestation from Brazilian soy than palm oil.

According to the latest data from Statista:

In 2023, China's soybean import volume amounted to approximately 99.41 million metric tons, representing a slight increase of about nine percent from 91.08 million metric tons in the previous year. Soybean is one of the most imported agricultural products in China.

Increasing soy imports has led to decreasing palm oil imports. According to Reuters:

Palm olein imports to top buyer China could fall by 26% to 3.1 million metric tons in 2024 as the most widely used edible oil loses pricing edge over rival soy oil, an executive at Cargill Investments (China) Ltd said on Wednesday.

A record South American soybean crop has pushed down prices for the primary competitor, which typically trades at a premium to palm oil, hurting demand for the latter.

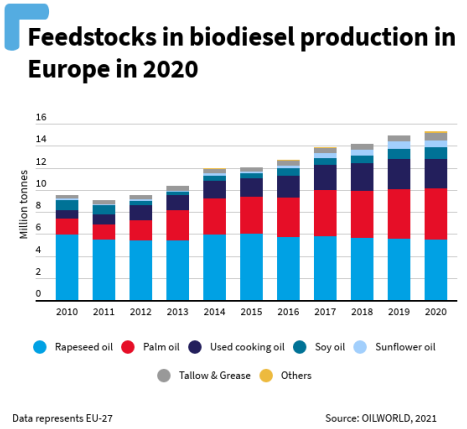

With palm oil losing market share in China due to its higher cost compared to soy, the other source of vegetable oils for the EU's biofuels programme is rapeseed. This must frighten Transport & Environment which has shied away from any criticism of rapeseed for biofuels as it is the major European crop for EU biofuels.

Rapeseed Oil remains a Primary Feedstock For German Biodiesel according to industry group Union zur Förderung von Oel- und Proteinpflanzen (UFOP).

Rapeseed also happens to be a major Chinese seed oil crop with annual productions several times more than its import of palm oil. In terms of realistic percentages of, Chinese UCOs are most likely to contain soy, followed by rapeseed before palm oil.

Yet Transport & Environment offered only crickets when UFOP warned there will not be enough rapeseed to feed and fuel the European Union. Sustainably that is.

Fact finding on China’s UCOs exports

The EU's use of agricultural lands to produce rapeseed for biofuels is questionable when food security for the EU is not assured. What is assured is the protectionist stance to protect European rapeseed industries is risking the EU's goals to decarbonise the transport sector with the aid of biofuels. That’s a long debate for another day but getting back to the spike in Chinese UCOs.

Bloomberg reported on the issue:

A spike in Chinese exports to Europe over the past year has coincided with a significant increase in Chinese imports of palm waste and palm-based biofuel from Indonesia and Malaysia. This should explain why Chinese exports of UCOs were able to react so fast to Europe's demand for UCOs.

But imports of palm waste or even palm-based biofuel pales in comparison to the enormous potential for China to produce biofuels from its own waste oils. The thing is that way before used cooking oils found demand in transportation, an illegal industry for gutter oil was already thriving in China

Grist reported back in 2010 on the prevalence of gutter oil or swill oil being reused as cooking oil. This disgusting industry was covered by the Washington Post in You may never eat street food in China again after watching this video

A report by MICHÈLE ZOLLINGER in 2015 for Yale Environment Review found that:

China's food culture depends heavily on cooking oil for daily use. In fact, the country produces 2.73 times as much gutter oil as the European Union, the U.S. and Canada combined. However, 10 percent of this cooking oil comes from illegally used gutter oil, which threatens human health. SkyNRG, a Dutch company and world leader and supplier in sustainable jet fuel, succeeded in producing aviation biofuel from waste cooking oil. Thanks to China's abundant waste oil there is a huge potential to recycle Chinese waste oil for bio jet fuel production.

The Chinese government’s crackdown on gutter oil has reduced the use of gutter oils for consumers but the collection network installed by this illegal industry may explain why China has so much used cooking oils to offer to towards its UCOs exports.

The origins of China's used cooking oils is impossible to trace beyond the haphazard declarations of Transport & Environment that it contains virgin palm oil. One can only expect more crickets from T&E to the trade and vegetable oil industry data presented above.

Meanwhile SP Global reported that Southeast Asia to play significant role in SAF production but lacks policies and cooperation. Malaysia has presented itself as capable of meeting international standards including CORSIA, EURefuel and the US's Sustainable Aviation Fuel Roadmap. A Malaysian source of SAFs simplifies supply chain complexities as Malaysian palm oil wastes would most certainly contain mostly palm oil. This may keep T&E up at night when EU transport decarbonisation goals are met with palm oil in the form of used cooking oils and agri wastes.

Update August 28, 2023

Indonesia biofuels insights from Katadata supports the idea that biofuels from China, may contain more Brazilian soy than Indonesian palm oil

https://dinsights.katadata.co.id/read/2023/08/28/weekly-digest-why-europe-feels-threatened-by-indonesian-biodiesel

Indonesia biofuels insights from Katadata supports the idea that biofuels from China, may contain more Brazilian soy than Indonesian palm oil

https://dinsights.katadata.co.id/read/2023/08/28/weekly-digest-why-europe-feels-threatened-by-indonesian-biodiesel

|

|

|

Update May 26, 2023

The European feedstock market faces disruption as imported biodiesel contamination concerns mount according to Mintec.

"FEDIOL, the industry association representing the vegetable oil and protein meal sector, on 25th May raised concerns over the surge in imported biodiesel, highlighting its disruptive impact. Simultaneously, Mintec has learned, according to market players, that waste oil from China, labelled as Used Cooking Oil (UCO), may be contaminated with significant amounts of palm oil, undermining its green credentials.

With FEDIOL stressing the urgency of investigating the authenticity of these biodiesel imports and highlighting abnormal market behaviour, the rapeseed market has been severely affected. Over the past six months, rapeseed oil prices have plummeted significantly, reaching the lowest level since June 2022, according to Mintec's Benchmark Price for Rapeseed Oil FOB Rotterdam, which stood at €774.50/mt on 25th May. The decline in prices can be attributed, in part, to the reduced demand from the biodiesel sector. Market players have shown limited interest in purchasing rapeseed oil as they import second-generation biofuels from China due to supposed sustainability benefits."

Mintec should update its trade data. Second generation biofuels from China are 10x more likely to be from soy than palm oil.

The European feedstock market faces disruption as imported biodiesel contamination concerns mount according to Mintec.

"FEDIOL, the industry association representing the vegetable oil and protein meal sector, on 25th May raised concerns over the surge in imported biodiesel, highlighting its disruptive impact. Simultaneously, Mintec has learned, according to market players, that waste oil from China, labelled as Used Cooking Oil (UCO), may be contaminated with significant amounts of palm oil, undermining its green credentials.

With FEDIOL stressing the urgency of investigating the authenticity of these biodiesel imports and highlighting abnormal market behaviour, the rapeseed market has been severely affected. Over the past six months, rapeseed oil prices have plummeted significantly, reaching the lowest level since June 2022, according to Mintec's Benchmark Price for Rapeseed Oil FOB Rotterdam, which stood at €774.50/mt on 25th May. The decline in prices can be attributed, in part, to the reduced demand from the biodiesel sector. Market players have shown limited interest in purchasing rapeseed oil as they import second-generation biofuels from China due to supposed sustainability benefits."

Mintec should update its trade data. Second generation biofuels from China are 10x more likely to be from soy than palm oil.

Update September 13, 2022

It has been "revealed" that Ireland is breaching the EU's limits on biofuels. The report from Sean Goulding Carroll of Euractiv is utter nonsense as he insinuates, without providing evidence, that Irish Used Cooking Oils (UCO) could have come from Asian countries. Instead, he writes that Malaysia is an emerging hub for the UCO trade and props up the concern by providing a link to an Index Mundi statistic that Malaysia is the second largest producer of palm oil globally. The fact that Malaysia is only an emerging hub makes for a weak prop to support his insinuation that Irish UCOs contain palm oil.

CSPO Watch has written on UCOs and palm oil where China, being the largest importer of soy and exporter of UCO, brings the risk of deforestation in Latin American soy, to EU UCO imports. Sean should do some research on UCO sources for the EU.

It has been "revealed" that Ireland is breaching the EU's limits on biofuels. The report from Sean Goulding Carroll of Euractiv is utter nonsense as he insinuates, without providing evidence, that Irish Used Cooking Oils (UCO) could have come from Asian countries. Instead, he writes that Malaysia is an emerging hub for the UCO trade and props up the concern by providing a link to an Index Mundi statistic that Malaysia is the second largest producer of palm oil globally. The fact that Malaysia is only an emerging hub makes for a weak prop to support his insinuation that Irish UCOs contain palm oil.

CSPO Watch has written on UCOs and palm oil where China, being the largest importer of soy and exporter of UCO, brings the risk of deforestation in Latin American soy, to EU UCO imports. Sean should do some research on UCO sources for the EU.

Original Post from July 2022

There is a smell emanating from Used Cooking Oils (UCOs) coming out of the EU. The approval of the European Parliament of draft Sustainable Aviation Fuels (SAF) targets under the ReFuelEU initiative is likely to increase the smell. But where is it coming from?

Green MEPs have been reported as being dissatisfied with the EU Commission’s handling of “fraud concerns” in the supply of UCOs for EU biofuels

Five Greens lawmakers – Ciarán Cuffe, Jutta Paulus, Ville Niinistö, Martin Häusling, and Rasmus Andresen – sent letters to the EU executive in April formally asking for all data obtained under voluntary UCO certification schemes to be made public.

The MEPs’ letters came in the wake of a finding of “maladministration” towards the European Commission by the EU Ombudsman. The Strasbourg-based watchdog made the ruling due to the Commission’s refusal to furnish information on UCO imports in response to a citizen request.

According to Industry and Energy, Europe’s demand for used cooking oil (UCO) to power its transport could double in 2030 leaving it increasingly reliant on dubious imports.

The EU promotes UCO under its green fuels law despite over half of it coming from abroad. The EU’s own auditors have raised concerns over inadequate systems to stop virgin oils like palm, which drive deforestation, being passed off as used. Transport & Environment (T&E), which commissioned the report, called on the EU to limit UCO in transport and improve monitoring to avoid fueling deforestation.

There is a smell emanating from Used Cooking Oils (UCOs) coming out of the EU. The approval of the European Parliament of draft Sustainable Aviation Fuels (SAF) targets under the ReFuelEU initiative is likely to increase the smell. But where is it coming from?

Green MEPs have been reported as being dissatisfied with the EU Commission’s handling of “fraud concerns” in the supply of UCOs for EU biofuels

Five Greens lawmakers – Ciarán Cuffe, Jutta Paulus, Ville Niinistö, Martin Häusling, and Rasmus Andresen – sent letters to the EU executive in April formally asking for all data obtained under voluntary UCO certification schemes to be made public.

The MEPs’ letters came in the wake of a finding of “maladministration” towards the European Commission by the EU Ombudsman. The Strasbourg-based watchdog made the ruling due to the Commission’s refusal to furnish information on UCO imports in response to a citizen request.

According to Industry and Energy, Europe’s demand for used cooking oil (UCO) to power its transport could double in 2030 leaving it increasingly reliant on dubious imports.

The EU promotes UCO under its green fuels law despite over half of it coming from abroad. The EU’s own auditors have raised concerns over inadequate systems to stop virgin oils like palm, which drive deforestation, being passed off as used. Transport & Environment (T&E), which commissioned the report, called on the EU to limit UCO in transport and improve monitoring to avoid fueling deforestation.

Industry and Energy quoted T&E staffer, Cristina Mestre, biofuels and grants and fundraising manager as saying: “Europe’s thirst for used cooking oil to power its transport sector is outstripping the amount leftover from the continent’s deep fryers. This leaves us reliant on a waste product being shipped from the other side of the world.”

Ignoring the Elephants in The Room

It is worth noting at this point, that Transport & Environment, is an Euro-centric group that holds an anti-palm oil position for reasons known only to the group.

Their diatribes against palm oil preys upon the popular myths that EU use of biofuels will increase deforestation in Indonesia. This is not surprising when one considers the fact that the salaries at Transport & Environment are paid by entities who whitewash their profits by making charitable donations to groups like T&E.

Winning an argument against a group supported by those with deep pockets is near impossible. One can only reveal the facts behind what they are talking about and hope that the policy makers in the EU can distinguish between fact and fiction.

There are several elephants in the room which need to be called out in the EU’s preference for UCOs in renewable energy. The biggest elephant here is as Transport & Environment acknowledges:

China supplies over a third of Europe’s UCO imports.

The problem with UCOs from China is not palm oil. It is soybeans, particularly those from South and Central America.

China, the world's top importer of soybeans, brought in 9.04 million tonnes of the oilseed from Brazil in August, up from 8.15 million tonnes a year earlier, data from the General Administration of Customs showed. Chinese crushers stepped up soybean purchases last year to meet strong demand as the country rebuilt its pig herd after it was decimated by deadly African swine fever.

In contrast, imports from the United States last month fell to 17,575 tonnes, down 89.4% from 166,370 tonnes in August 2020.Nasdaq

This is not some blip in soybean trade like the US-China political tensions. It is a continuing trend as Statista reports.

Soybean is Brazil’s main export commodity. In 2019, Brazil held the top rank as China’s largest soybean supplier with a market share of 65 percent. The United States and Argentina were also among the top three soybean supplying countries to China.

The drop in China’s import of US soybeans is relevant to the EU’s increased risk of deforestation as US soy has stronger sustainability credentials than those from South and Central America. The Netherlands, as an EU powerhouse in the global trade of agricultural products is the largest importer of Brazilian goods which should be of serious concern to the EU.

These are publicly available facts and statistics which Transport & Environment should be aware as their single-minded focus on palm oil as being bad for the planet is a disservice to the global fight against climate change.

But it is not only the purveyors of misinformation like Transport & Environment that are guilty of sabotaging the EU’s efforts to reduce its emissions. Policy makers and influencers from the EU Commission to the Council and Parliament are equally guilty of using half-truths and misleading information provided by groups like Transport & Environment to drive political self-interests.

Facts vs Supposition

Nowhere is the misinformation more apparent than a reach back to recent times when Brazil and Indonesia were reported to be struggling with efforts to reduce deforestation.

Since that report from 2015, a comparison of developments between soy powerhouse, Brazil, and palm oil powerhouse, Indonesia shows a stark difference in reducing deforestation.

Brazil sees record Amazon deforestation in first half of 2022

Record low deforestation rates in Indonesia despite ongoing pandemic

These are hard facts compared to any namby-pamby theories by Transport & Environment like “Countries that would use UCO for animal feed and other products may end up exporting theirs while using cheap oil, like palm, at home.”

Their previous play of ILUC, which was picked up by EU policy makers, must have failed in the face of challenges by palm oil producing countries which is leading to this desperate pitch that somehow, somewhere, palm oil is bad for EU.

Transport $ Environment may be excused for cringing at the facts and even refuse to accept them but there is no denying that sustainably produced palm oil, is an energy solution that the EU sorely needs.

The only fact that Transport & Environment admitted, is that there simply isn’t enough clean UCOs to fill the huge demand for SAF. But knowing China’s business-smarts for creating supply for high demand products, the MEPs should be concerned about deforestation from soy in UCOs, not palm oil.

Published July 2022. CSPO Watch

Ignoring the Elephants in The Room

It is worth noting at this point, that Transport & Environment, is an Euro-centric group that holds an anti-palm oil position for reasons known only to the group.

Their diatribes against palm oil preys upon the popular myths that EU use of biofuels will increase deforestation in Indonesia. This is not surprising when one considers the fact that the salaries at Transport & Environment are paid by entities who whitewash their profits by making charitable donations to groups like T&E.

Winning an argument against a group supported by those with deep pockets is near impossible. One can only reveal the facts behind what they are talking about and hope that the policy makers in the EU can distinguish between fact and fiction.

There are several elephants in the room which need to be called out in the EU’s preference for UCOs in renewable energy. The biggest elephant here is as Transport & Environment acknowledges:

China supplies over a third of Europe’s UCO imports.

The problem with UCOs from China is not palm oil. It is soybeans, particularly those from South and Central America.

China, the world's top importer of soybeans, brought in 9.04 million tonnes of the oilseed from Brazil in August, up from 8.15 million tonnes a year earlier, data from the General Administration of Customs showed. Chinese crushers stepped up soybean purchases last year to meet strong demand as the country rebuilt its pig herd after it was decimated by deadly African swine fever.

In contrast, imports from the United States last month fell to 17,575 tonnes, down 89.4% from 166,370 tonnes in August 2020.Nasdaq

This is not some blip in soybean trade like the US-China political tensions. It is a continuing trend as Statista reports.

Soybean is Brazil’s main export commodity. In 2019, Brazil held the top rank as China’s largest soybean supplier with a market share of 65 percent. The United States and Argentina were also among the top three soybean supplying countries to China.

The drop in China’s import of US soybeans is relevant to the EU’s increased risk of deforestation as US soy has stronger sustainability credentials than those from South and Central America. The Netherlands, as an EU powerhouse in the global trade of agricultural products is the largest importer of Brazilian goods which should be of serious concern to the EU.

These are publicly available facts and statistics which Transport & Environment should be aware as their single-minded focus on palm oil as being bad for the planet is a disservice to the global fight against climate change.

But it is not only the purveyors of misinformation like Transport & Environment that are guilty of sabotaging the EU’s efforts to reduce its emissions. Policy makers and influencers from the EU Commission to the Council and Parliament are equally guilty of using half-truths and misleading information provided by groups like Transport & Environment to drive political self-interests.

Facts vs Supposition

Nowhere is the misinformation more apparent than a reach back to recent times when Brazil and Indonesia were reported to be struggling with efforts to reduce deforestation.

Since that report from 2015, a comparison of developments between soy powerhouse, Brazil, and palm oil powerhouse, Indonesia shows a stark difference in reducing deforestation.

Brazil sees record Amazon deforestation in first half of 2022

Record low deforestation rates in Indonesia despite ongoing pandemic

These are hard facts compared to any namby-pamby theories by Transport & Environment like “Countries that would use UCO for animal feed and other products may end up exporting theirs while using cheap oil, like palm, at home.”

Their previous play of ILUC, which was picked up by EU policy makers, must have failed in the face of challenges by palm oil producing countries which is leading to this desperate pitch that somehow, somewhere, palm oil is bad for EU.

Transport $ Environment may be excused for cringing at the facts and even refuse to accept them but there is no denying that sustainably produced palm oil, is an energy solution that the EU sorely needs.

The only fact that Transport & Environment admitted, is that there simply isn’t enough clean UCOs to fill the huge demand for SAF. But knowing China’s business-smarts for creating supply for high demand products, the MEPs should be concerned about deforestation from soy in UCOs, not palm oil.

Published July 2022. CSPO Watch